The dataset Electric Production contains time series data spans from January 1985 to January 2018 related to electricity production in the U.S., as represented by the Industrial Production Index (IPI) for the Electric Power sector. It consists of two columns:

DATE: This column contains dates in a month/day/year format (e.g., 1/1/1985). It represents the time period corresponding to the monthly measurements of electricity production.

IPG2211A2N: Numeric values of the Industrial Production Index for electric power generation, transmission, and distribution. The values indicate the output levels of electricity production over time, with a base level of 100 typically representing a standard or reference period. The values in this dataset reflect monthly changes in electricity production, with higher values indicating greater production levels.

Data Source : https://www.kaggle.com/datasets/shenba/time-series-datasets?select=Electric_Production.csv

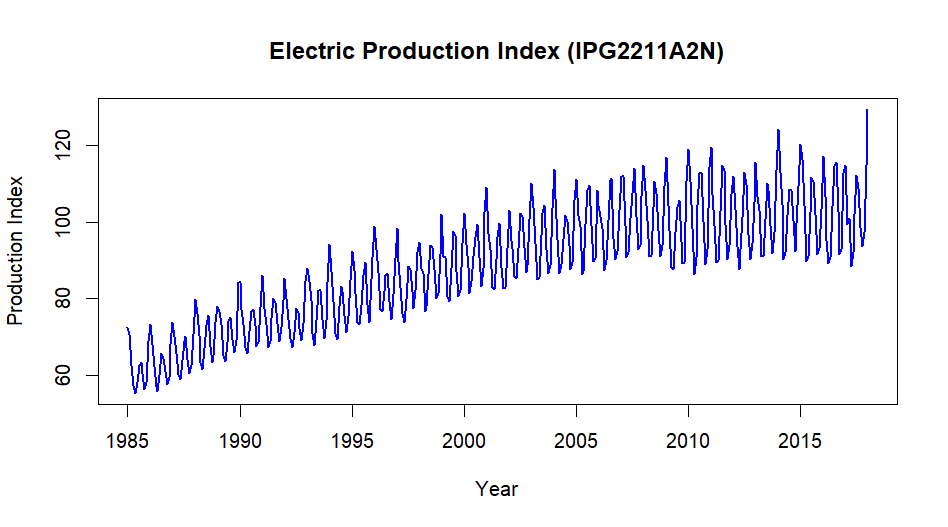

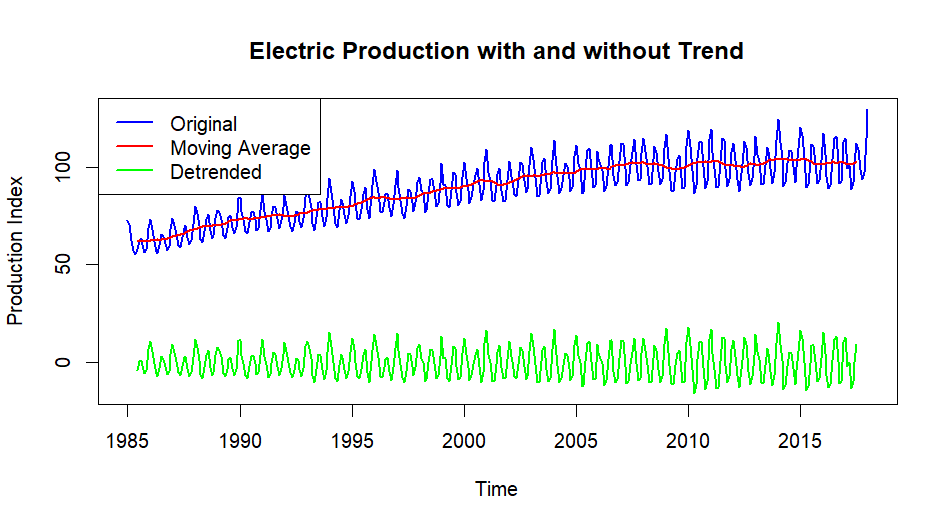

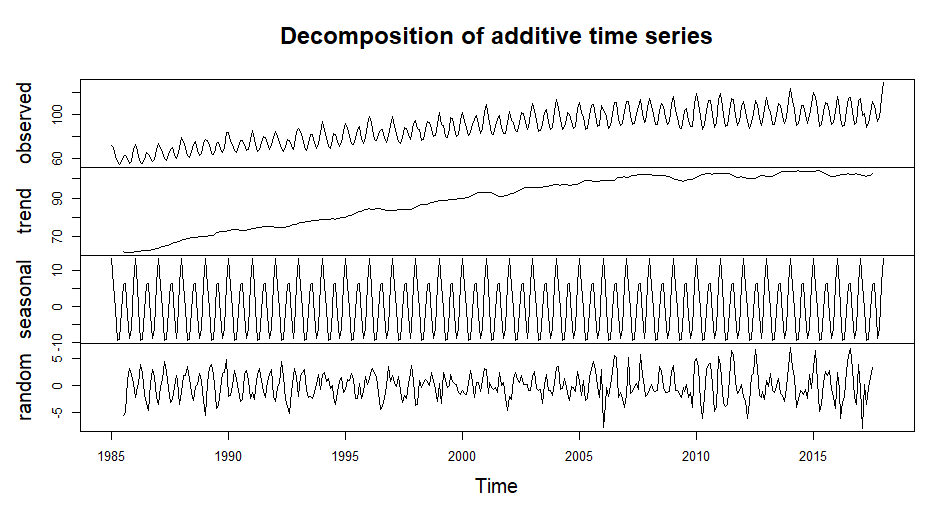

Exploratory Data Analysis

By looking at the above plot we can see, there is an upward trend over the period of time.

summary(Electric_Production$IPG2211A2N)

Min. 1st Qu. Median Mean 3rd Qu. Max.

55.32 77.11 89.78 88.85 100.52 129.40

The minimum production recorded is 55.32, while the maximum is 129.40, indicating a significant range of variability. The first quartile (77.11) and third quartile (100.52) show that 25% of values are below 77.11 and 75% are below 100.52, respectively. The median production level is 89.78, and the mean is 88.85, suggesting a fairly symmetrical distribution.

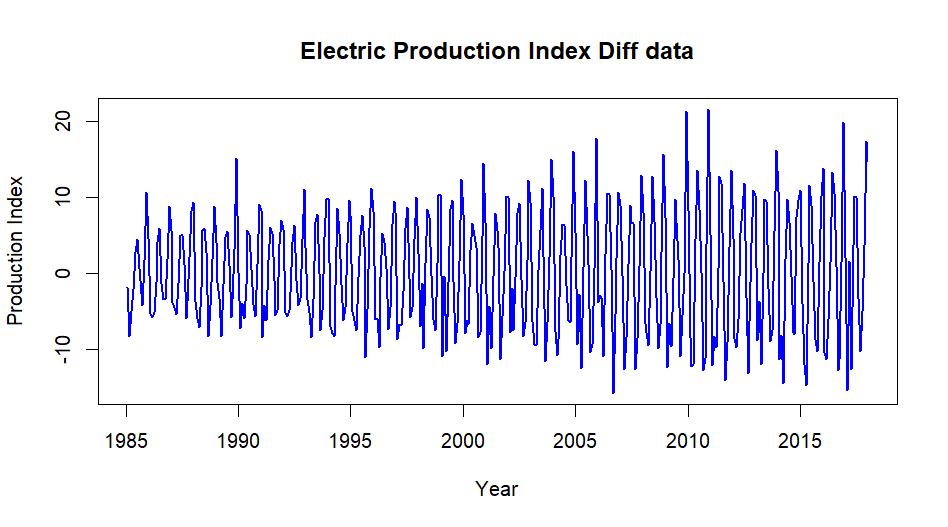

Check for Stationarity

Augmented Dickey-Fuller Test

Null Hypothesis: Time Series is non-stationary.

Augmented Dickey-Fuller Test

data: Electric_Production_TS

Dickey-Fuller = -5.139, Lag order = 7, p-value = 0.01

alternative hypothesis: stationary

The p-value of 0.01 is less than the common significance level of 0.05. This indicates that we can reject the null hypothesis.This implies that the time series is stationary.

from above plot of difference data we can it better stationary.

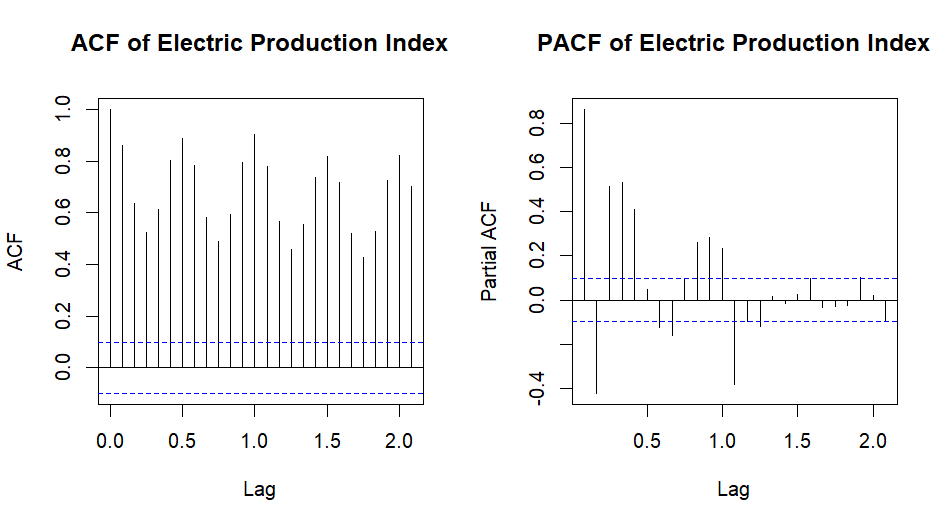

Model Selection

Call:

arima(x = Electric_Production_TS, order = c(10, 0, 0))

Coefficients:

ar1 ar2 ar3 ar4 ar5 ar6 ar7 ar8 ar9 ar10

0.8893 -0.2684 -0.0491 -0.0294 0.2108 0.0918 0.1189 -0.1810 -0.1400 0.3527

s.e. 0.0474 0.0646 0.0654 0.0651 0.0646 0.0648 0.0649 0.0651 0.0644 0.0475

intercept

86.1337

s.e. 17.9707

sigma^2 estimated as 12.41: log likelihood = -1067.66, aic = 2159.31

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set 0.352722 3.522736 2.596595 0.2713289 2.865757 0.3942434 -0.1616198

Augmented Dickey-Fuller Test

data: ar10_model$residuals

Dickey-Fuller = -12.441, Lag order = 7, p-value = 0.01

alternative hypothesis: stationary

The AR(10) model was fitted to the Electric Production Index time series data, which reveal a strong autoregressive structure with significant coefficients for the first, second, and tenth lags. The model’s intercept is approximately 86.13, indicating the average level of the production index after accounting for the autoregressive effects. The estimated variance of the residuals is around 12.41, with a log-likelihood of -1067.66 and an AIC of 2159.31, suggesting a reasonable fit to the data.

The training set error measures indicate that the model performs well, with a Root Mean Square Error (RMSE) of approximately 3.52 and a Mean Absolute Percentage Error (MAPE) of about 2.87%. To assess the model’s adequacy, the Augmented Dickey-Fuller (ADF) test was conducted on the residuals, yielding a test statistic of -12.441 and a p-value less than 0.01. This result allows us to reject the null hypothesis of non-stationarity, confirming that the residuals are stationary. Overall, the AR(10) model appears to be a suitable choice for capturing the dynamics of the Electric Production Index time series.

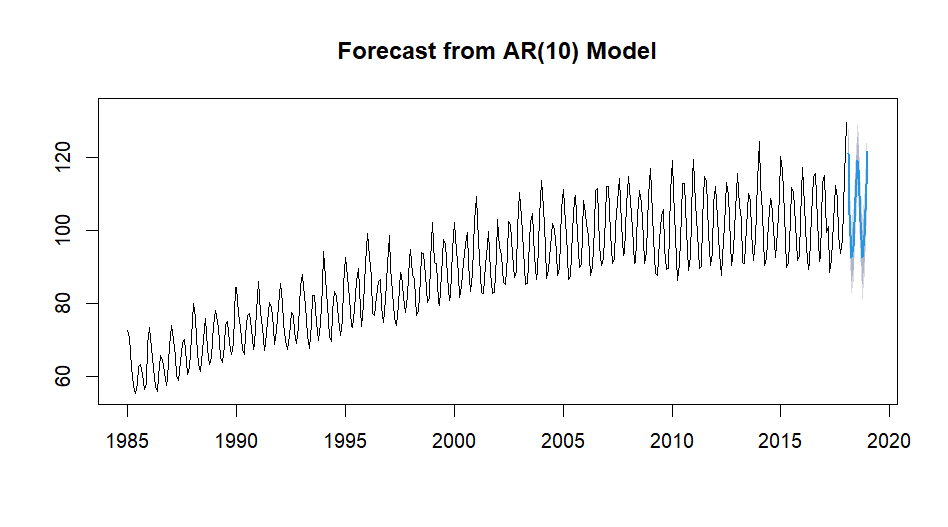

Forecasting

> forecasted_values

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

Feb 2018 121.03762 116.52305 125.55219 114.13318 127.9421

Mar 2018 104.40256 98.36111 110.44401 95.16296 113.6422

Apr 2018 92.45776 85.97233 98.94318 82.53915 102.3764

May 2018 95.53647 89.00216 102.07078 85.54310 105.5298

Jun 2018 108.88904 102.34982 115.42826 98.88816 118.8899

Jul 2018 119.05189 112.50675 125.59704 109.04196 129.0618

Aug 2018 116.74574 110.03810 123.45339 106.48729 127.0042

Sep 2018 102.40295 95.20120 109.60469 91.38883 113.4171

Oct 2018 92.54003 85.07210 100.00797 81.11881 103.9613

Nov 2018 98.47060 91.00218 105.93902 87.04864 109.8926

Dec 2018 112.43758 104.96903 119.90613 101.01541 123.8597

Jan 2019 121.45486 113.91214 128.99758 109.91926 132.9904